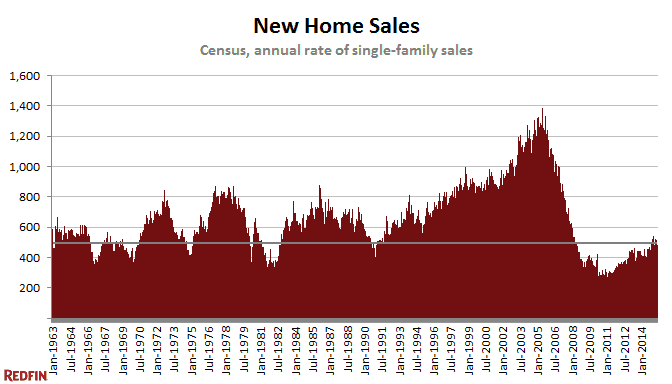

Where Will Everybody Live? New Homes Aren’t Keeping Up

While it’s rarely a good idea to put much stock in a single piece of economic data, the trend in new home sales has been disappointing for a while. Builders simply aren’t constructing enough houses accommodate population growth. It’s one factor of many contributing to the rapid rise in housing costs.