More Properties Command Above List Price in Washington D.C.

Washington, D.C., home values rose 5% in April from a year ago as limited inventory and continuing competition pushed more buyers to pay above asking price.

Washington, D.C., home values rose 5% in April from a year ago as limited inventory and continuing competition pushed more buyers to pay above asking price.

Chicago home prices notched their fourth-straight month of double-digit growth in April, with the median sale price rising 10 percent from a year ago. The number of properties sold fell 4.8 percent, and the city’s median sale price reached $275,000 as the spring selling season got into full swing. On average, homes fetched 96.6 percent of their asking price, the highest sale-to-list ratio since last July.

Want to cut thousands of dollars and years off your mortgage? All it takes are a few simple steps! But here’s a word of advice—don’t pay someone to do it for you, and do your homework first. Sometimes those savings aren’t what they’re cracked up to be.

Profits are weakening, and Fannie Mae and Freddie Mac might be even more fiscally fragile today than they were in 2008. That means a ripple in the housing market could leave taxpayers on the hook for another bailout. For that we can blame Congress and the White House, which never got around to fixing the companies after the mortgage meltdown. That indifference could cost us as much as $157.3 billion for a second bailout if the economy goes really south.

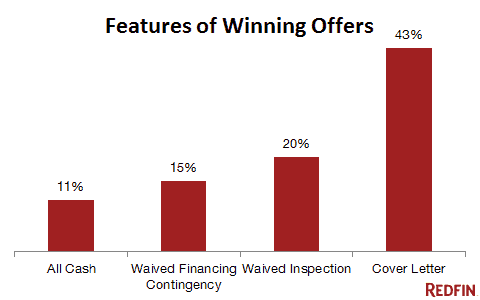

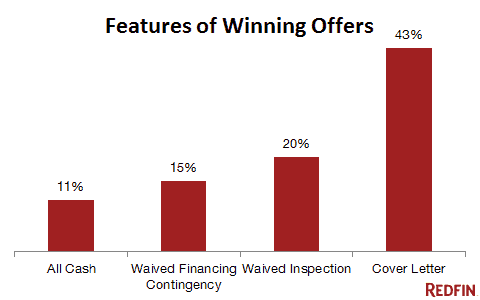

Bidding wars gained steam as the spring home-buying season got under way, with 61 percent of offers written by Redfin agents facing competition from other buyers in March. That’s up from 57 percent in February, but down slightly from 63 percent in March 2014.

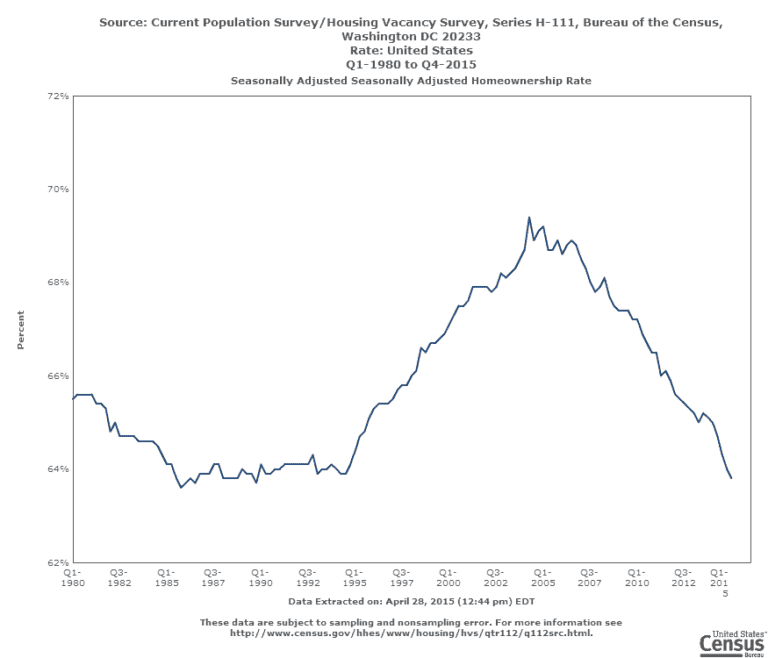

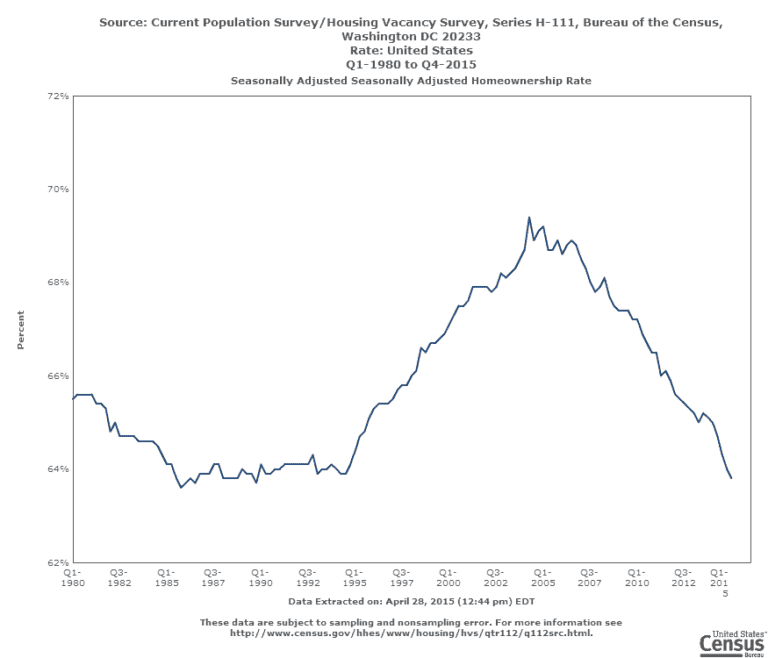

Homeownership fell to its lowest level since 1989, to 63.8 percent. The last time it was this low, gas cost less than $1 a gallon, Paula Abdul was topping the charts and mortgage interest rates were above 10 percent. Millennials like Sara Stevens, 28, might be one reason the rate is so low.

Washington, D.C., home values rose 5% in April from a year ago as limited inventory and continuing competition pushed more buyers to pay above asking price.

Chicago home prices notched their fourth-straight month of double-digit growth in April, with the median sale price rising 10 percent from a year ago. The number of properties sold fell 4.8 percent, and the city’s median sale price reached $275,000 as the spring selling season got into full swing. On average, homes fetched 96.6 percent of their asking price, the highest sale-to-list ratio since last July.

Want to cut thousands of dollars and years off your mortgage? All it takes are a few simple steps! But here’s a word of advice—don’t pay someone to do it for you, and do your homework first. Sometimes those savings aren’t what they’re cracked up to be.

Profits are weakening, and Fannie Mae and Freddie Mac might be even more fiscally fragile today than they were in 2008. That means a ripple in the housing market could leave taxpayers on the hook for another bailout. For that we can blame Congress and the White House, which never got around to fixing the companies after the mortgage meltdown. That indifference could cost us as much as $157.3 billion for a second bailout if the economy goes really south.

Bidding wars gained steam as the spring home-buying season got under way, with 61 percent of offers written by Redfin agents facing competition from other buyers in March. That’s up from 57 percent in February, but down slightly from 63 percent in March 2014.

Homeownership fell to its lowest level since 1989, to 63.8 percent. The last time it was this low, gas cost less than $1 a gallon, Paula Abdul was topping the charts and mortgage interest rates were above 10 percent. Millennials like Sara Stevens, 28, might be one reason the rate is so low.