Here’s the #1 Reason It’s so Hard to Find an Affordable Home

Under building of new homes and high construction cost perpetuate the affordable housing shortage.

Taylor Marr is the deputy chief economist on the research team at Redfin. He is passionate about housing and urban policy and an advocate for increased mobility and affordability. He laid the framework for our migration data and reports and diligently tracks the housing market and economy. Before Redfin, Taylor built financial market index funds for Vanguard at the University of Chicago. Taylor went to graduate school for international economics in Berlin, where he focused on behavioral causes of the global housing bubble and subsequent policy responses. Taylor’s research has been featured in the New York Times, the Wall Street Journal, and The Economist. He was also recently the President of the Seattle Economics Council and collaborates frequently with the Fed, HUD, and the Census Bureau. Follow him on Twitter @tayloramarr or subscribe to his weekly newsletter on Substack here: https://taylormarr.substack.com

Under building of new homes and high construction cost perpetuate the affordable housing shortage.

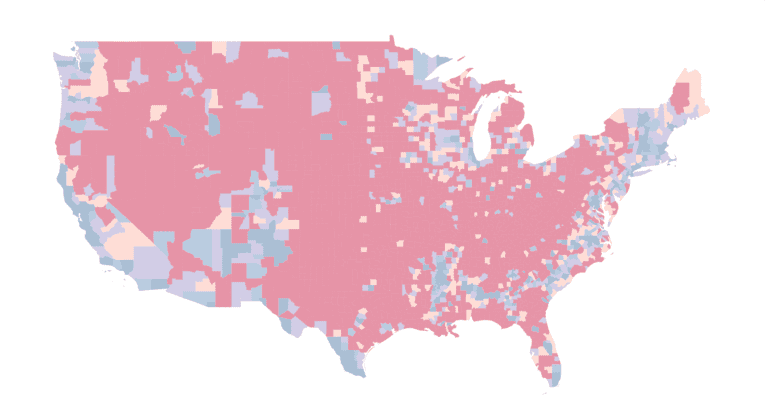

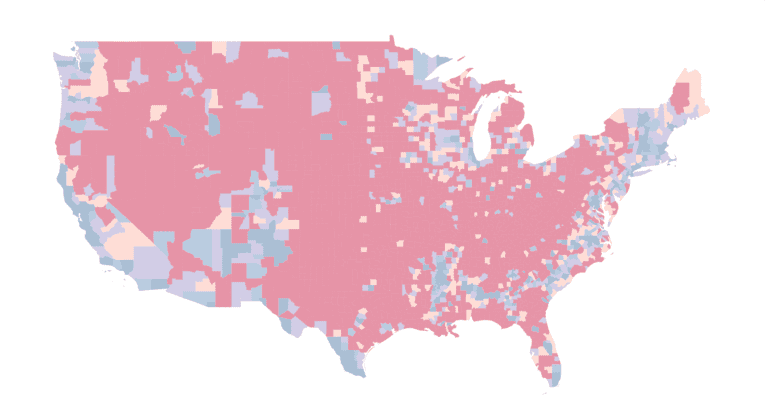

The housing affordability crisis is driving residents out of the most Democratic counties.

One in five Redfin users searched for homes outside their metro; Boston, Chicago and Seattle had the most loyal residents.

Redfin gathered data on eviction records to estimate the scale of the impact of today’s housing affordability crisis.

We crunched the data in 24 metros to compare the median financial portfolio performance with the median home price appreciation since 2010.

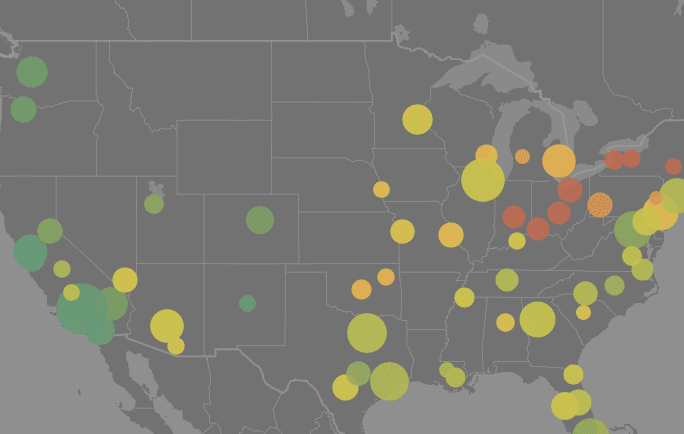

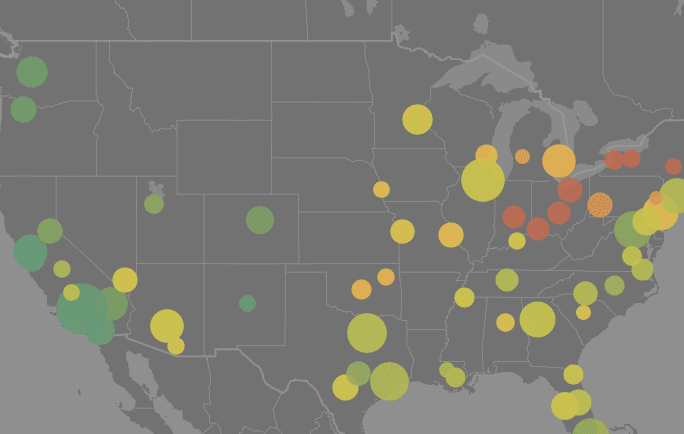

Energy costs can add more than 50 percent to annual housing costs in some areas in the Rust Belt, but less than five percent in much of California.

Under building of new homes and high construction cost perpetuate the affordable housing shortage.

The housing affordability crisis is driving residents out of the most Democratic counties.

One in five Redfin users searched for homes outside their metro; Boston, Chicago and Seattle had the most loyal residents.

Redfin gathered data on eviction records to estimate the scale of the impact of today’s housing affordability crisis.

We crunched the data in 24 metros to compare the median financial portfolio performance with the median home price appreciation since 2010.

Energy costs can add more than 50 percent to annual housing costs in some areas in the Rust Belt, but less than five percent in much of California.