Housing Market Update: Homebuyer Demand and Sellers’ Asking Prices Get a Late-Summer Boost

Home sale prices likely have room to grow as ultra-low mortgage rates lure more buyers to the market.

Tim Ellis has been analyzing the real estate market since 2005, and worked at Redfin as a housing market analyst from 2010 through 2013 and again starting in 2018. In his free time, he runs the independently-operated Seattle-area real estate website <a href="https://seattlebubble.com/" title="Seattle Bubble"><em>Seattle Bubble</em></a>, and produces the <a href="https://dispatches.fm/" title="Dispatches from the Multiverse">"Dispatches from the Multiverse" improvised comedy sci-fi podcast</a>.

Home sale prices likely have room to grow as ultra-low mortgage rates lure more buyers to the market.

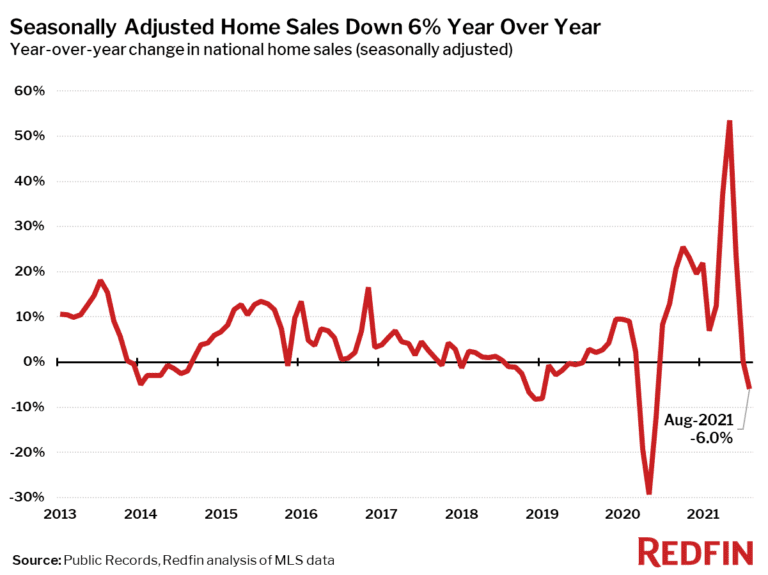

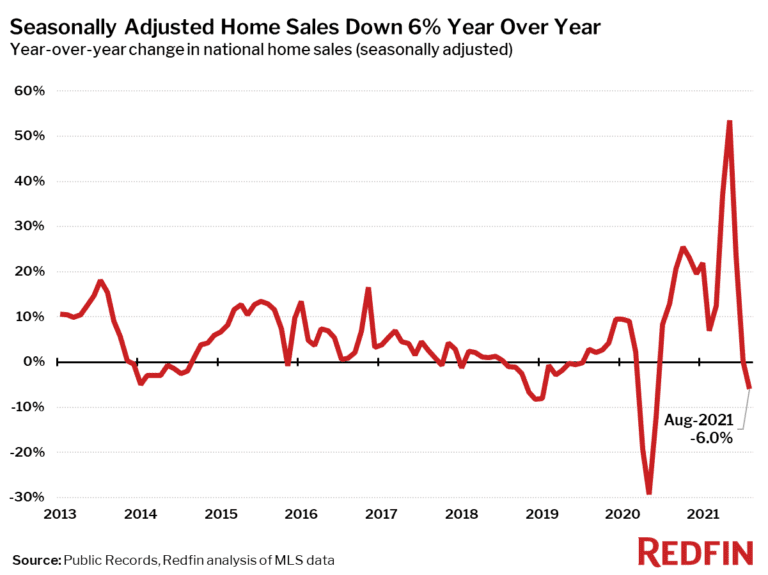

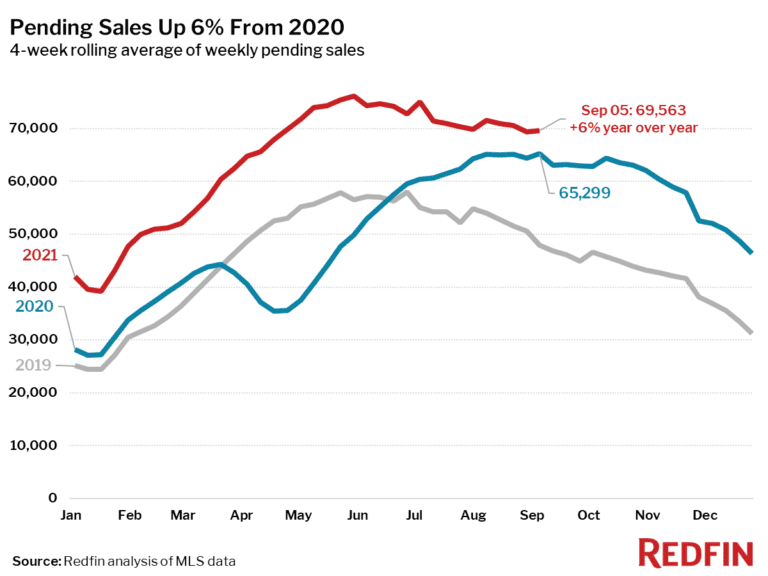

However, home prices were up 16%, and new listings posted their first year-over-year decline since February, which could signal a tightening market.

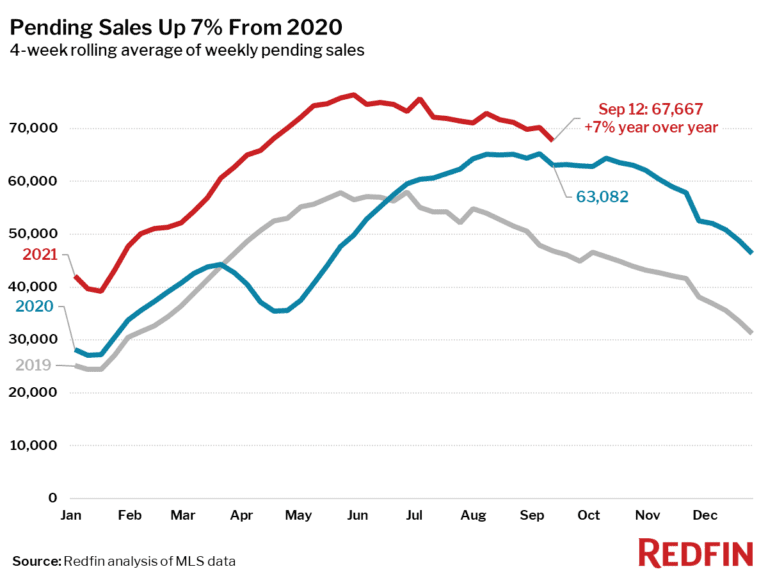

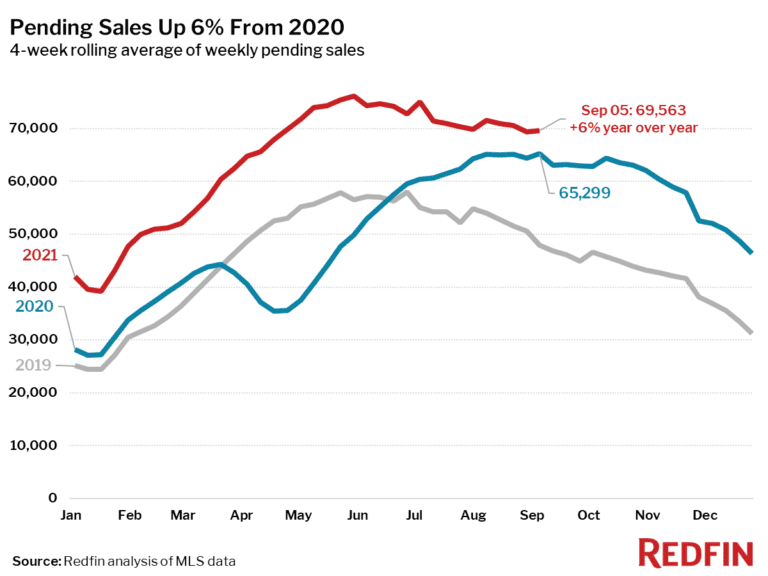

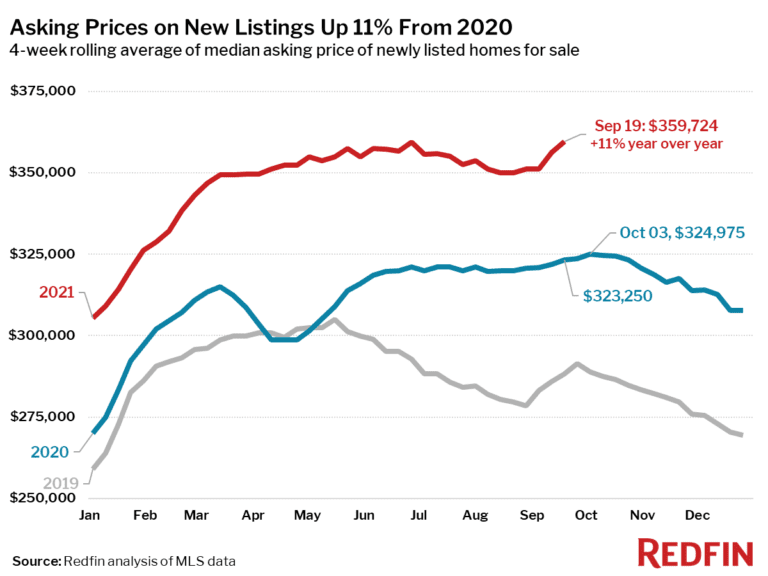

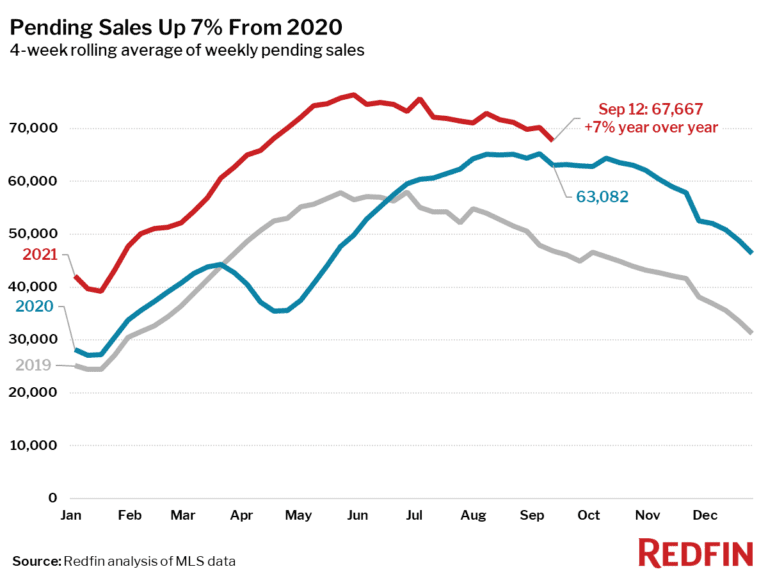

The 7% increase was the smallest since June 2020, but home prices rose 14% from a year earlier. Asking prices have also ticked up in recent weeks.

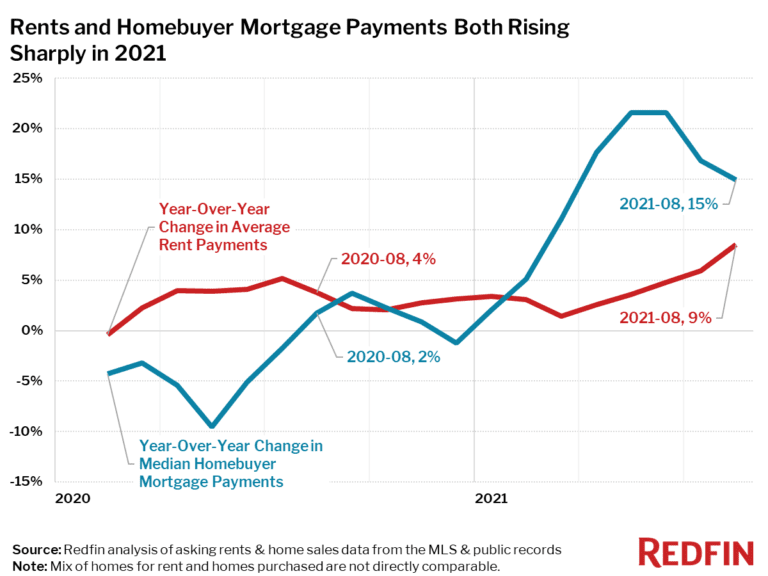

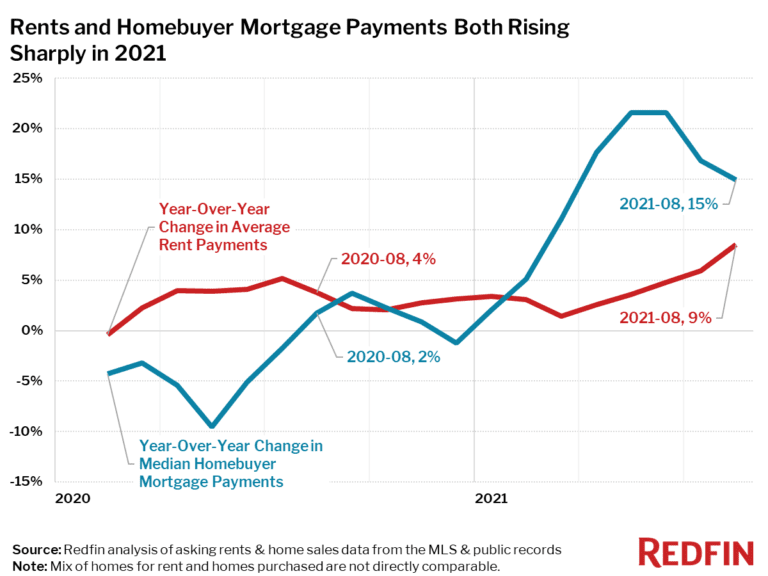

However, rents are climbing rapidly in some places, up over 20% from a year earlier in many Florida metros, Riverside, CA, Phoenix and Las Vegas.

Strong demand pushed home prices up 14% from a year earlier.

Homes are also taking longer to sell. Still, prices are up 15% from a year ago.

Home sale prices likely have room to grow as ultra-low mortgage rates lure more buyers to the market.

However, home prices were up 16%, and new listings posted their first year-over-year decline since February, which could signal a tightening market.

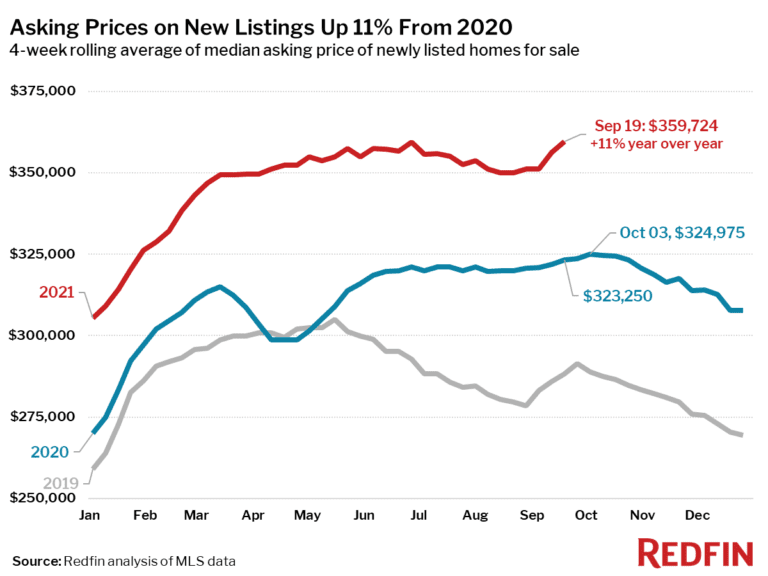

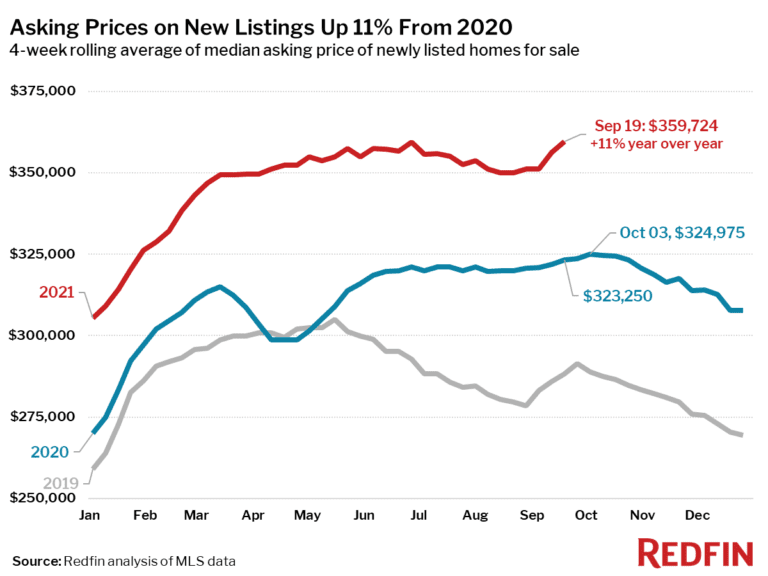

The 7% increase was the smallest since June 2020, but home prices rose 14% from a year earlier. Asking prices have also ticked up in recent weeks.

However, rents are climbing rapidly in some places, up over 20% from a year earlier in many Florida metros, Riverside, CA, Phoenix and Las Vegas.

Strong demand pushed home prices up 14% from a year earlier.

Homes are also taking longer to sell. Still, prices are up 15% from a year ago.