Pending Home Sales Approach 2019 Levels, Powered by Record-Low Mortgage Rates

Record-low mortgage interest rates below 3% drove pending sales to increase again, nearly to 2019 levels.

Tim Ellis has been analyzing the real estate market since 2005, and worked at Redfin as a housing market analyst from 2010 through 2013 and again starting in 2018. In his free time, he runs the independently-operated Seattle-area real estate website <a href="https://seattlebubble.com/" title="Seattle Bubble"><em>Seattle Bubble</em></a>, and produces the <a href="https://dispatches.fm/" title="Dispatches from the Multiverse">"Dispatches from the Multiverse" improvised comedy sci-fi podcast</a>.

Record-low mortgage interest rates below 3% drove pending sales to increase again, nearly to 2019 levels.

The impact of the coronavirus shutdowns on homebuyer demand has so far been short and muted, even in some of the cities that have been the hardest-hit by unemployment during the recession.

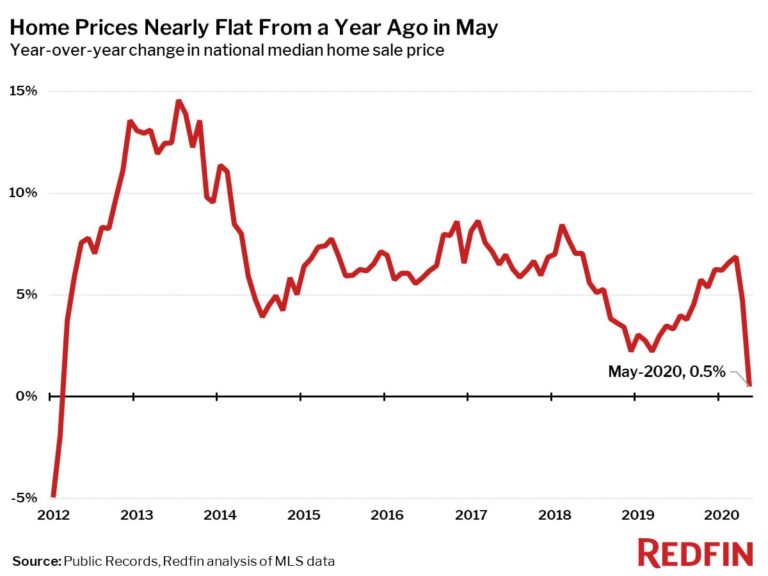

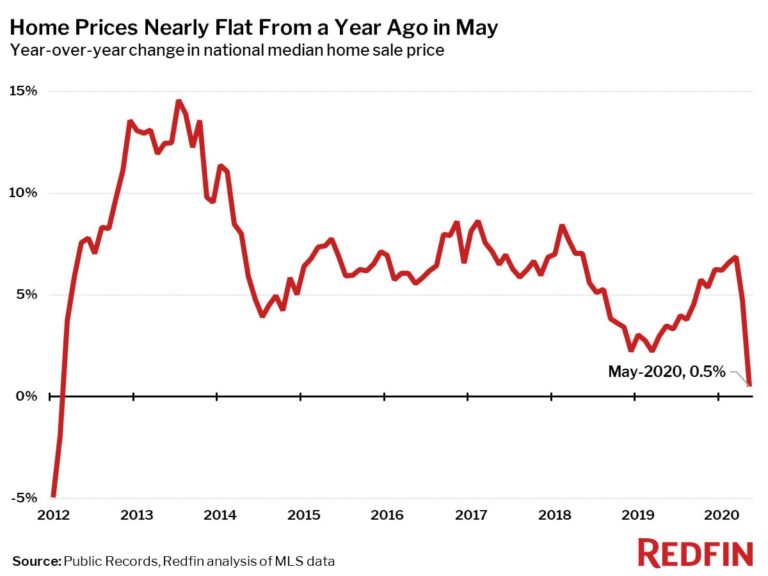

The housing market showed some early signs of recovery in May as new listings and pending sales both increased dramatically from April levels.

The effects of the coronavirus pandemic and subsequent shutdowns hit the housing market in full force in April.

The sudden shift to remote work, brought on by the coronavirus shutdowns will accelerate a major migration away from expensive coastal cities.

Between mid-March and mid-April, the new supply of homes for sale over $1 million fell 29 points from the year prior.

Record-low mortgage interest rates below 3% drove pending sales to increase again, nearly to 2019 levels.

The impact of the coronavirus shutdowns on homebuyer demand has so far been short and muted, even in some of the cities that have been the hardest-hit by unemployment during the recession.

The housing market showed some early signs of recovery in May as new listings and pending sales both increased dramatically from April levels.

The effects of the coronavirus pandemic and subsequent shutdowns hit the housing market in full force in April.

The sudden shift to remote work, brought on by the coronavirus shutdowns will accelerate a major migration away from expensive coastal cities.

Between mid-March and mid-April, the new supply of homes for sale over $1 million fell 29 points from the year prior.