Here’s What Homebuyers and Sellers Can Expect if the Fed Lowers Rates

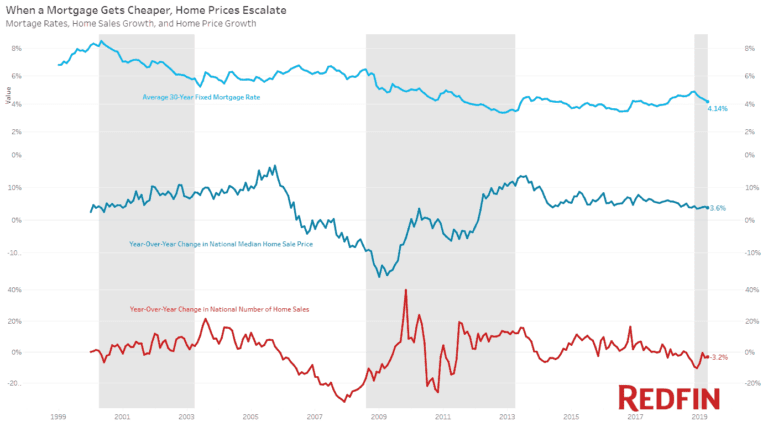

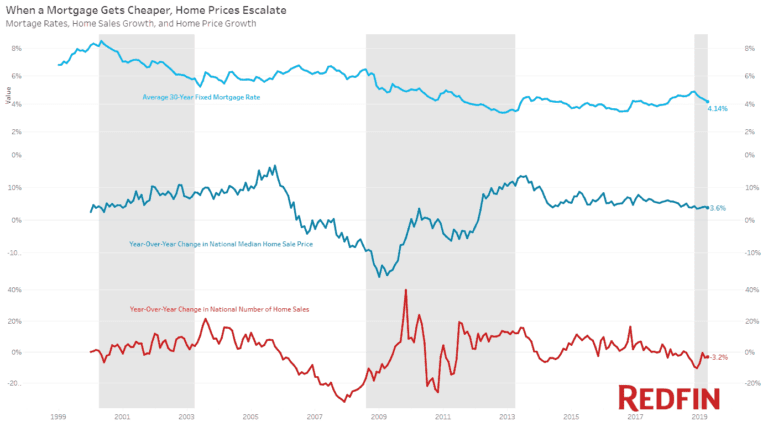

If expected rate cuts come, and translate to a decline in mortgage rates, we can expect the housing market to see yet another boost as a result.

Tim Ellis has been analyzing the real estate market since 2005, and worked at Redfin as a housing market analyst from 2010 through 2013 and again starting in 2018. In his free time, he runs the independently-operated Seattle-area real estate website <a href="https://seattlebubble.com/" title="Seattle Bubble"><em>Seattle Bubble</em></a>, and produces the <a href="https://dispatches.fm/" title="Dispatches from the Multiverse">"Dispatches from the Multiverse" improvised comedy sci-fi podcast</a>.

If expected rate cuts come, and translate to a decline in mortgage rates, we can expect the housing market to see yet another boost as a result.

Under Elizabeth Warren’s plan to cancel up to $50,000 of student loan debt, a typical aspiring homeowner currently laden with student debt could save a down payment three years faster.

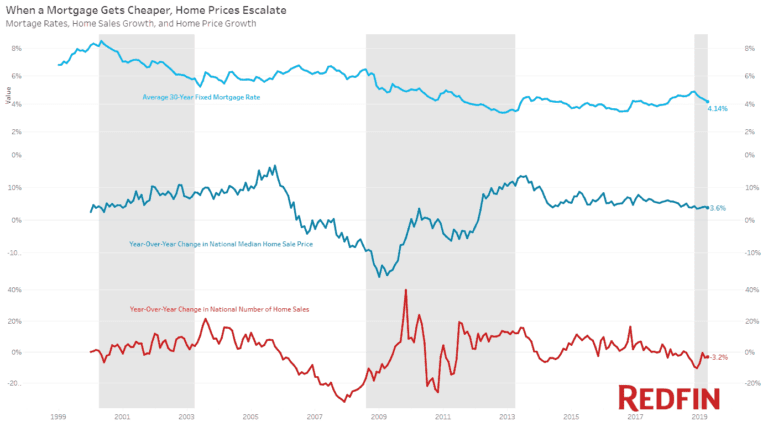

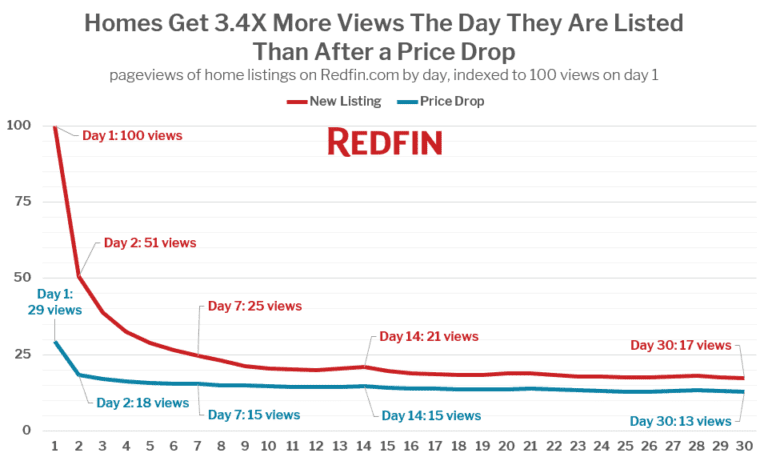

Homes get 3.4 times more online views the day they are listed than they do the day the seller drops the price.

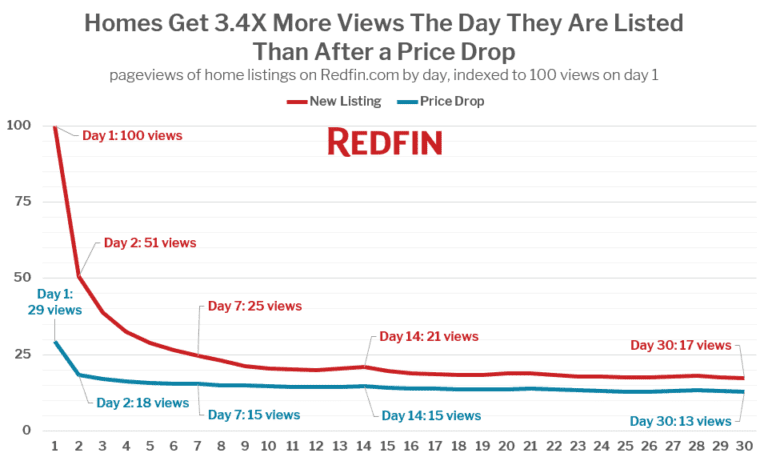

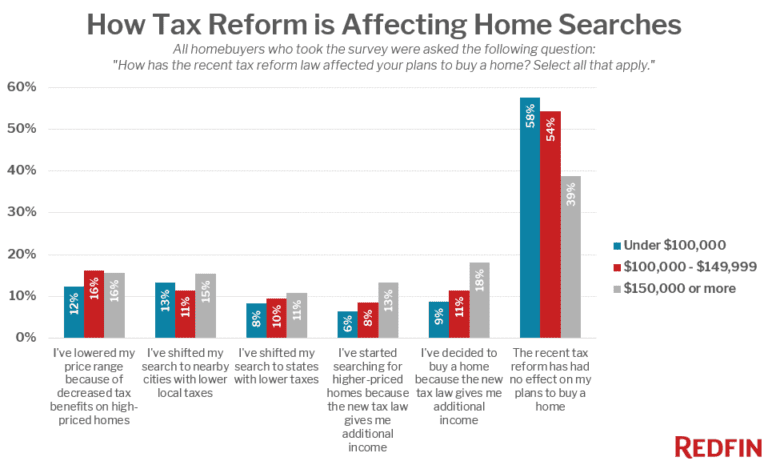

Over a year after the historic tax code overhaul, less than half of homebuyers say that tax reform has had an effect on their home search.

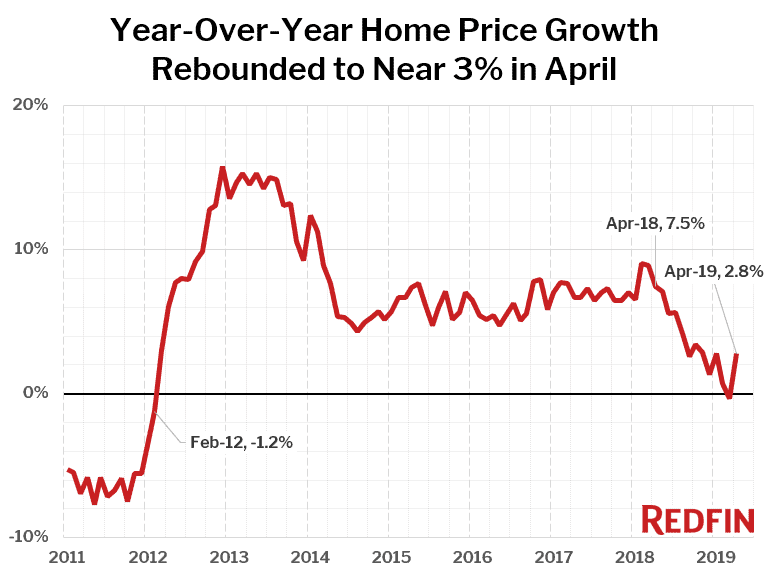

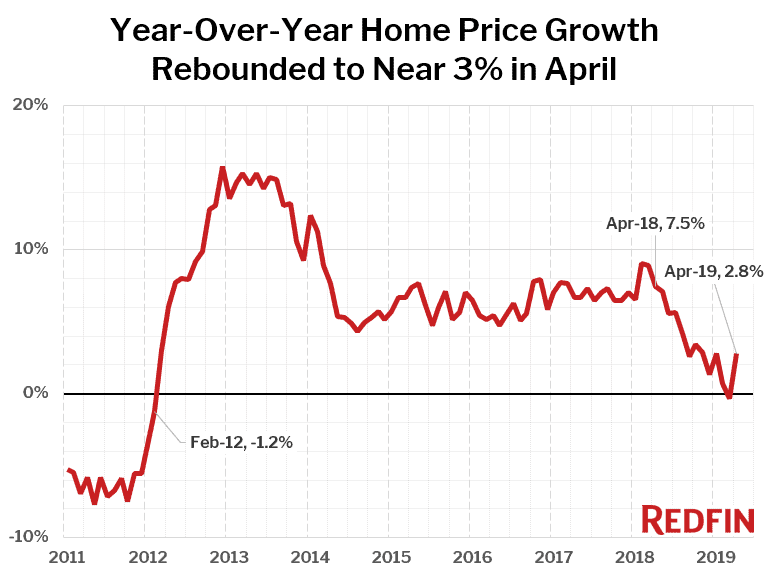

U.S. home-sale prices edged up in April, growing 2.8 percent from a year ago, to a median of $307,600 across the metros Redfin tracks.

Nationwide just 15 percent of offers faced competition in April. Just 15 percent of offers written by Redfin agents on behalf of their home-buying customers

If expected rate cuts come, and translate to a decline in mortgage rates, we can expect the housing market to see yet another boost as a result.

Under Elizabeth Warren’s plan to cancel up to $50,000 of student loan debt, a typical aspiring homeowner currently laden with student debt could save a down payment three years faster.

Homes get 3.4 times more online views the day they are listed than they do the day the seller drops the price.

Over a year after the historic tax code overhaul, less than half of homebuyers say that tax reform has had an effect on their home search.

U.S. home-sale prices edged up in April, growing 2.8 percent from a year ago, to a median of $307,600 across the metros Redfin tracks.

Nationwide just 15 percent of offers faced competition in April. Just 15 percent of offers written by Redfin agents on behalf of their home-buying customers