Housing Market Update: Homebuyer Demand Dips as Holiday Lull Amplifies Market Cooldown

Redfin’s Homebuyer Demand Index fell for the first time since June, and the share of home sellers dropping their asking price was the highest in five months.

Tim Ellis has been analyzing the real estate market since 2005, and worked at Redfin as a housing market analyst from 2010 through 2013 and again starting in 2018. In his free time, he runs the independently-operated Seattle-area real estate website <a href="https://seattlebubble.com/" title="Seattle Bubble"><em>Seattle Bubble</em></a>, and produces the <a href="https://dispatches.fm/" title="Dispatches from the Multiverse">"Dispatches from the Multiverse" improvised comedy sci-fi podcast</a>.

Redfin’s Homebuyer Demand Index fell for the first time since June, and the share of home sellers dropping their asking price was the highest in five months.

Rising monthly mortgage payments—up 34% from a year ago, due largely to rising interest rates–are pricing more people out of the homebuying market, which could lead to even more increases in rents.

The hottest March on record ended with early signs of a cooldown as more buyers were edged out by soaring mortgage rates, sky-high prices and

Early indicators of homebuyer activity falter further as mortgage rates shoot up.

12% of homes for sale had price drops in the past four weeks—the highest level since early December—suggesting that sellers’ tight grip on the market is starting to loosen.

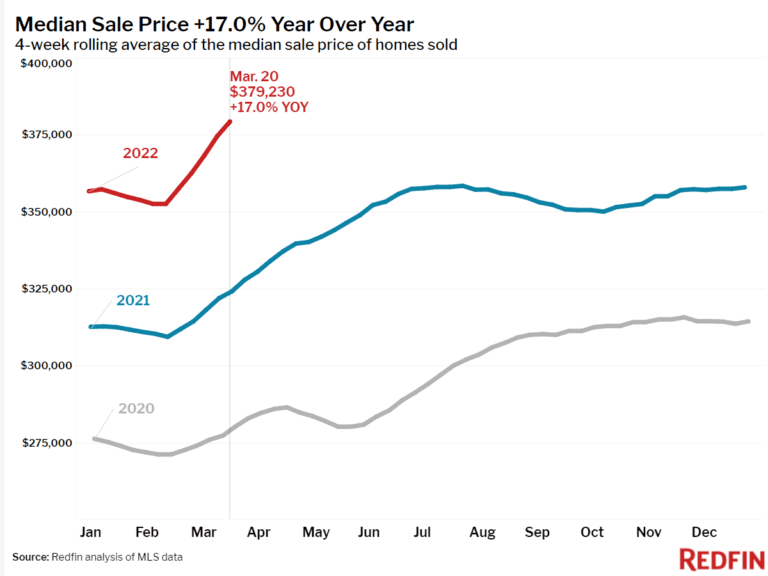

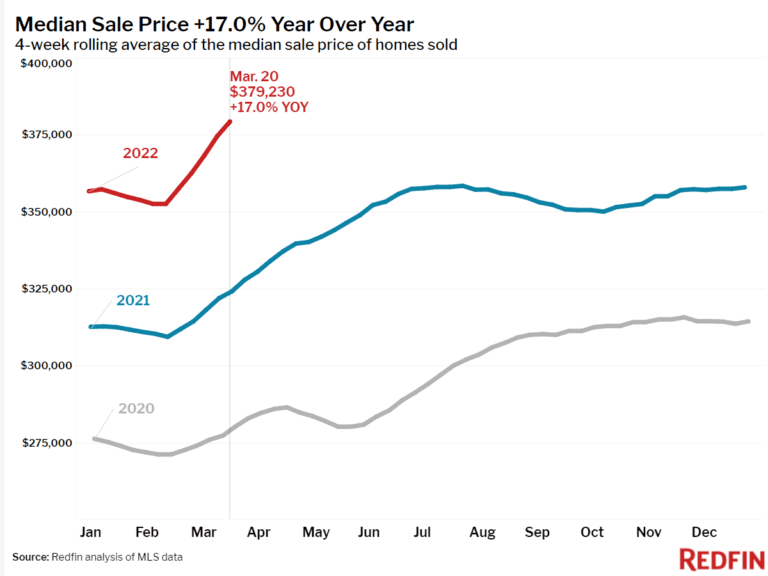

Homes sell even faster as dwindling supply and rapidly rising mortgage rates fuel fierce competition. Housing prices jumped the most since summer—up 17% year over

Redfin’s Homebuyer Demand Index fell for the first time since June, and the share of home sellers dropping their asking price was the highest in five months.

Rising monthly mortgage payments—up 34% from a year ago, due largely to rising interest rates–are pricing more people out of the homebuying market, which could lead to even more increases in rents.

The hottest March on record ended with early signs of a cooldown as more buyers were edged out by soaring mortgage rates, sky-high prices and

Early indicators of homebuyer activity falter further as mortgage rates shoot up.

12% of homes for sale had price drops in the past four weeks—the highest level since early December—suggesting that sellers’ tight grip on the market is starting to loosen.

Homes sell even faster as dwindling supply and rapidly rising mortgage rates fuel fierce competition. Housing prices jumped the most since summer—up 17% year over