Rental Market Tracker: Asking Rents Increased 40% Year Over Year in Austin

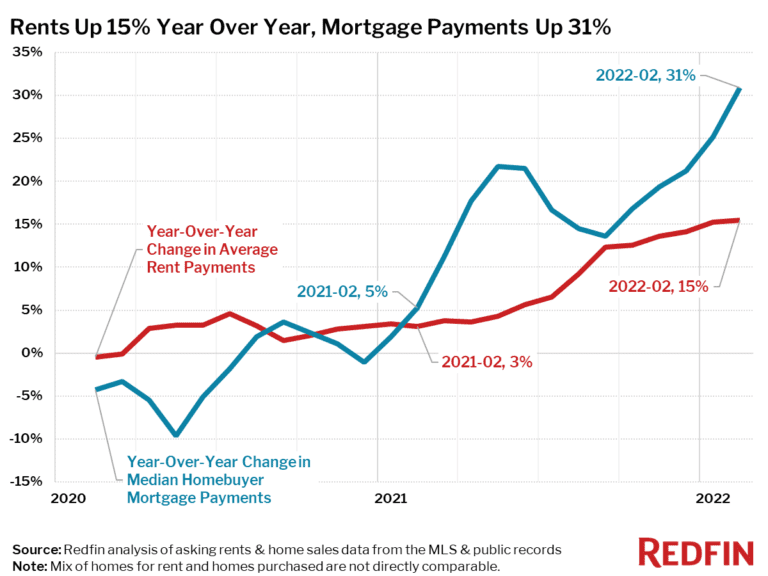

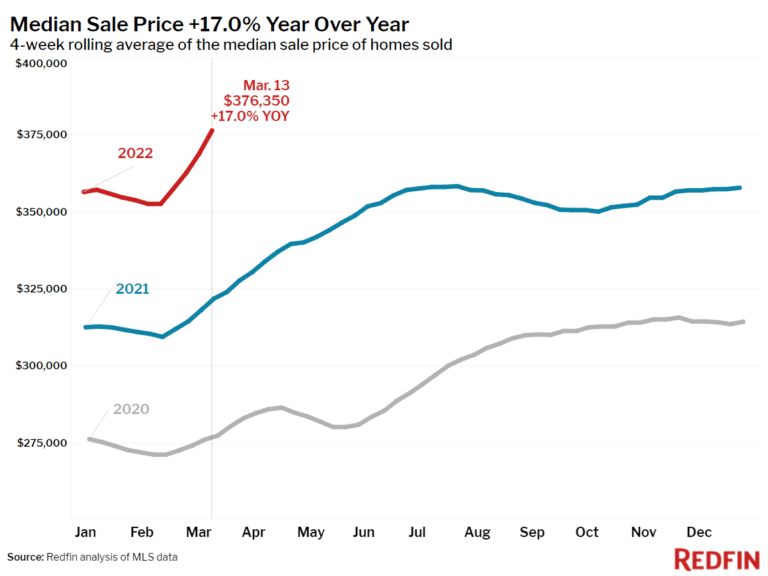

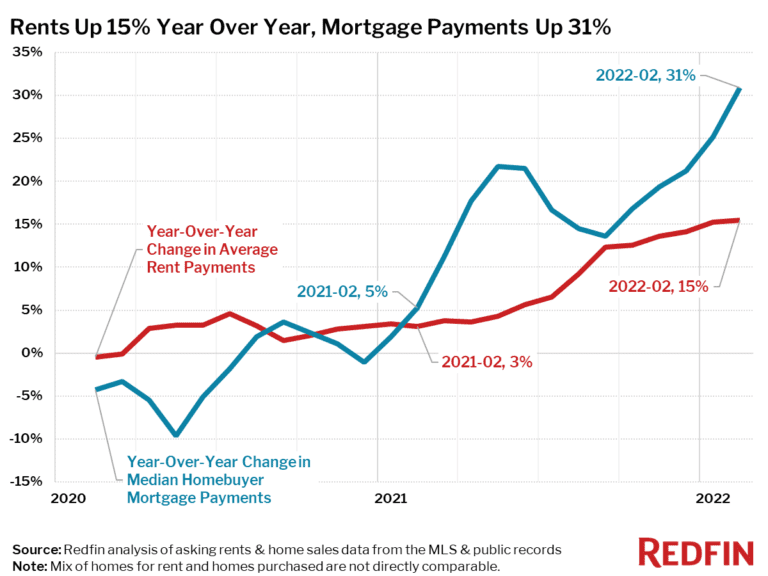

Nationally, asking rents were up 15% in February, while homebuyer mortgage payments increased twice as fast.

Tim Ellis has been analyzing the real estate market since 2005, and worked at Redfin as a housing market analyst from 2010 through 2013 and again starting in 2018. In his free time, he runs the independently-operated Seattle-area real estate website <a href="https://seattlebubble.com/" title="Seattle Bubble"><em>Seattle Bubble</em></a>, and produces the <a href="https://dispatches.fm/" title="Dispatches from the Multiverse">"Dispatches from the Multiverse" improvised comedy sci-fi podcast</a>.

Nationally, asking rents were up 15% in February, while homebuyer mortgage payments increased twice as fast.

Record-low supply spurs unprecedented winter homebuying competition.

Pending home sales continued to outpace 2021 even as the listing shortage dragged on and mortgage rates shot up to above 4% for the first time since May 2019.

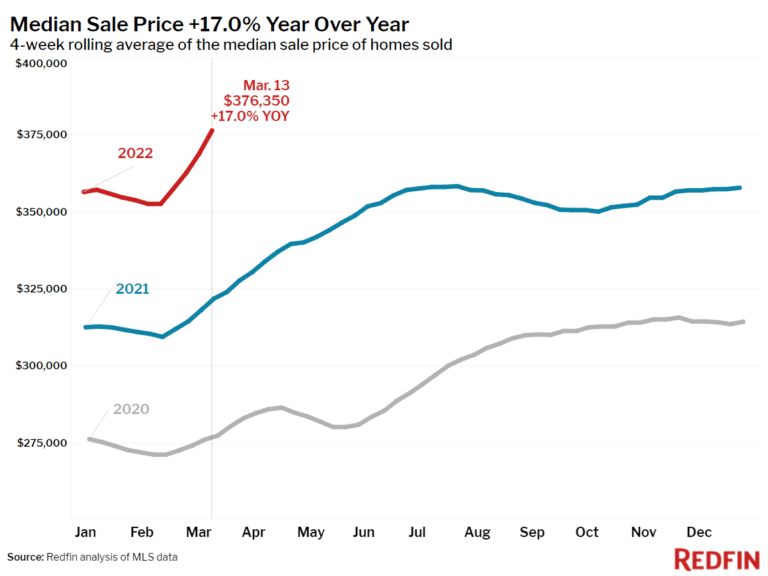

The housing market is worked into a frenzy, unfazed by war in Ukraine, a faltering stock market, and fast-rising gas prices.

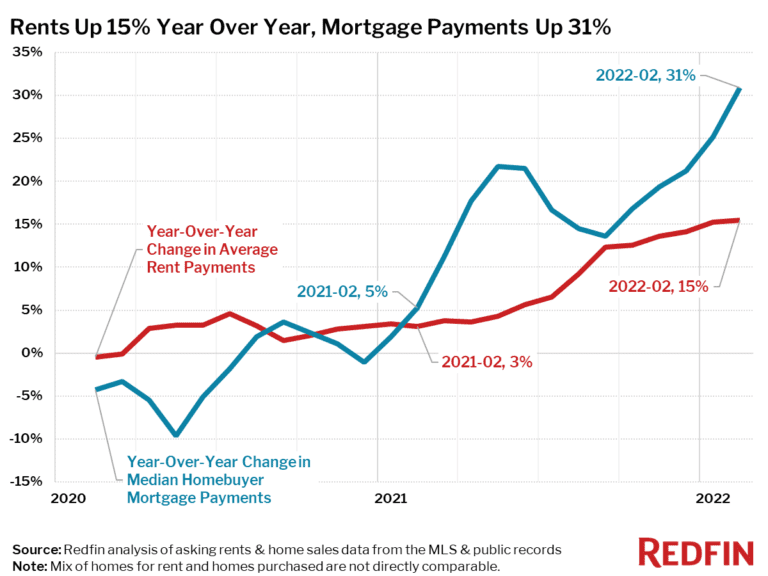

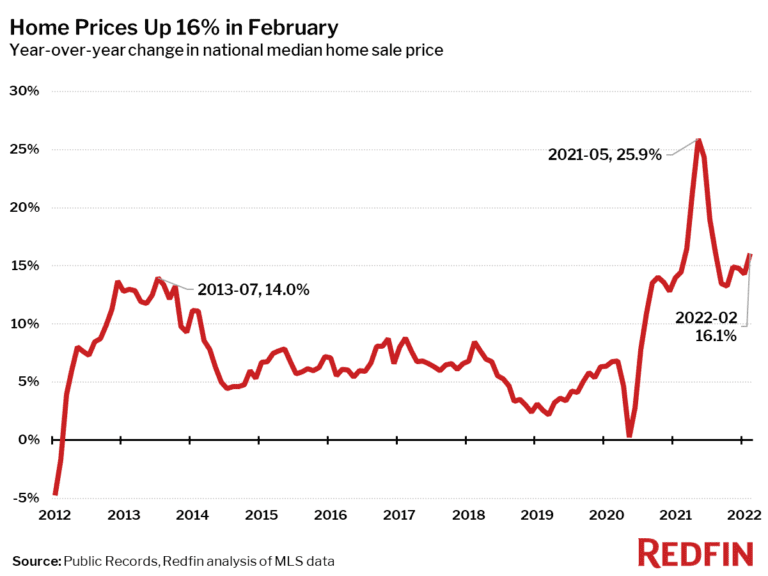

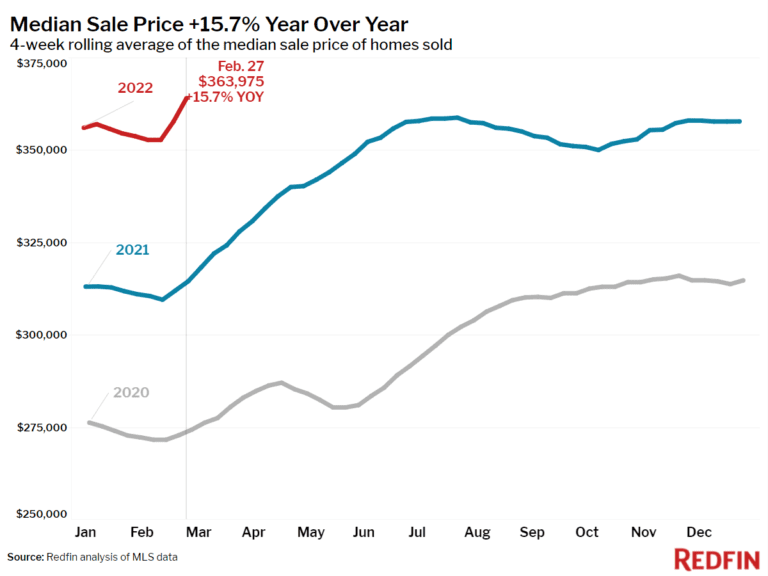

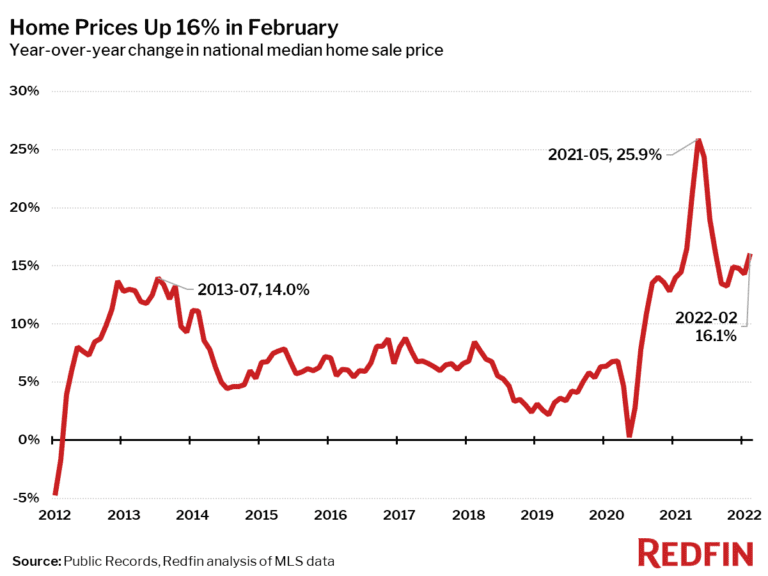

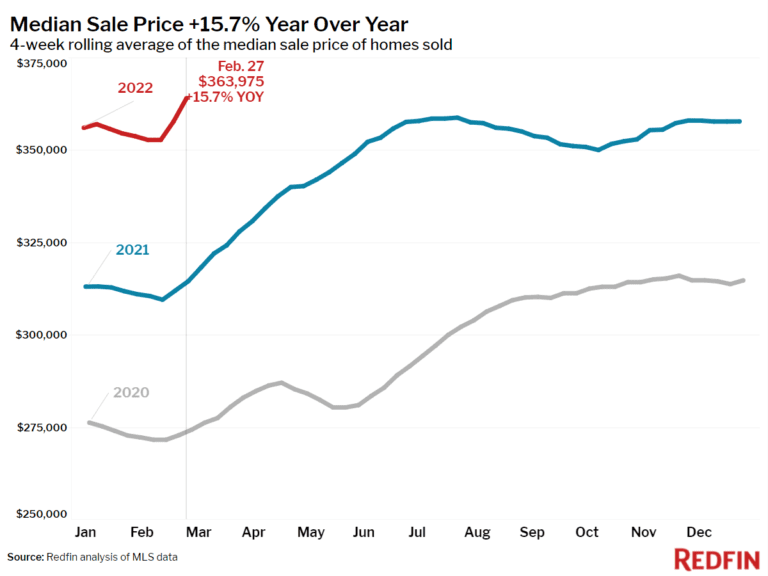

The median home sale price rose 16% from a year earlier, the largest increase since August. Tensions in Ukraine have stalled the rapid increase in mortgage rates.

New listings post smallest year-over-year decline since mid-November; pending sales rise 1%.

Nationally, asking rents were up 15% in February, while homebuyer mortgage payments increased twice as fast.

Record-low supply spurs unprecedented winter homebuying competition.

Pending home sales continued to outpace 2021 even as the listing shortage dragged on and mortgage rates shot up to above 4% for the first time since May 2019.

The housing market is worked into a frenzy, unfazed by war in Ukraine, a faltering stock market, and fast-rising gas prices.

The median home sale price rose 16% from a year earlier, the largest increase since August. Tensions in Ukraine have stalled the rapid increase in mortgage rates.

New listings post smallest year-over-year decline since mid-November; pending sales rise 1%.