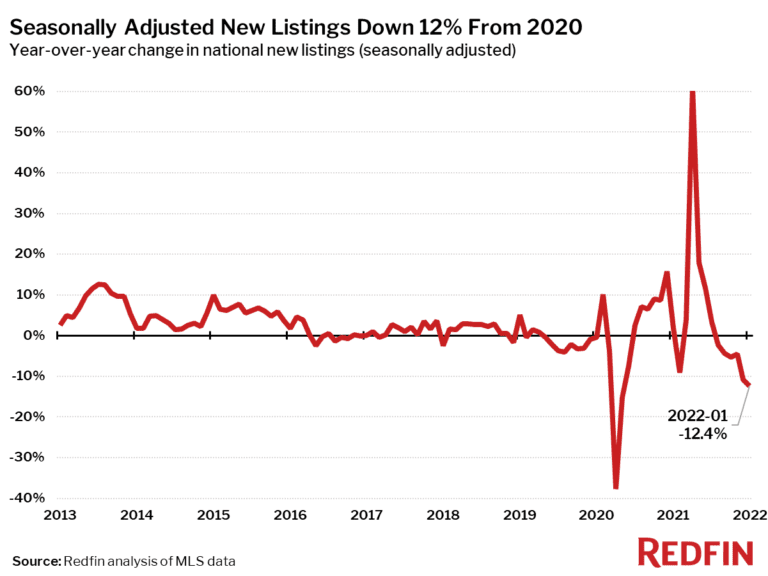

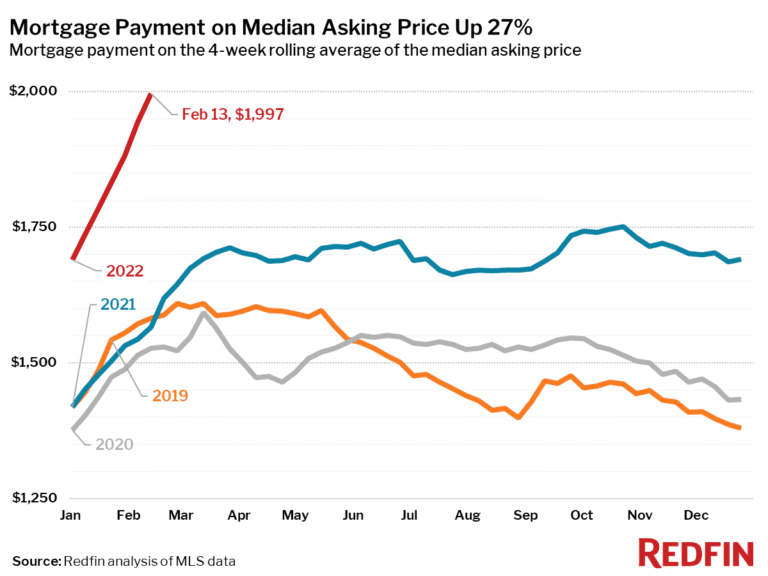

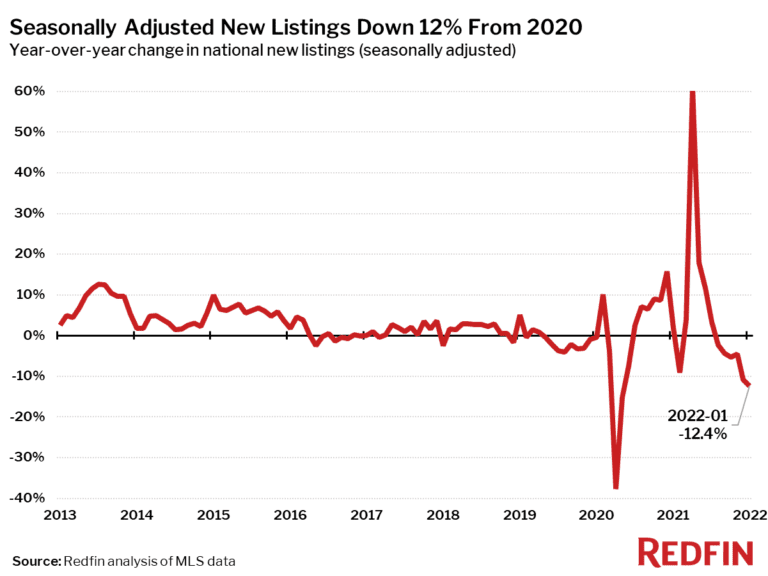

Newly Listed Homes in Short Supply, Down 12% in January

Home sales posted strong monthly gains despite rising mortgage rates and record-low supply.

Tim Ellis has been analyzing the real estate market since 2005, and worked at Redfin as a housing market analyst from 2010 through 2013 and again starting in 2018. In his free time, he runs the independently-operated Seattle-area real estate website <a href="https://seattlebubble.com/" title="Seattle Bubble"><em>Seattle Bubble</em></a>, and produces the <a href="https://dispatches.fm/" title="Dispatches from the Multiverse">"Dispatches from the Multiverse" improvised comedy sci-fi podcast</a>.

Home sales posted strong monthly gains despite rising mortgage rates and record-low supply.

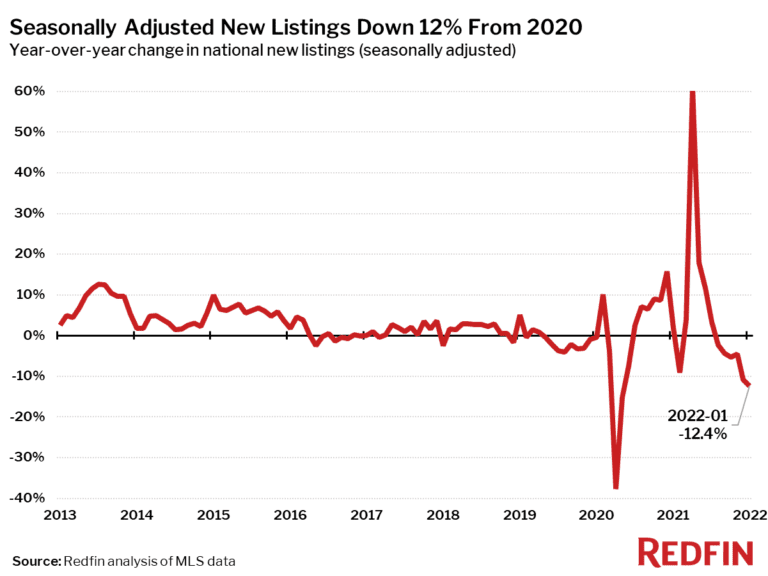

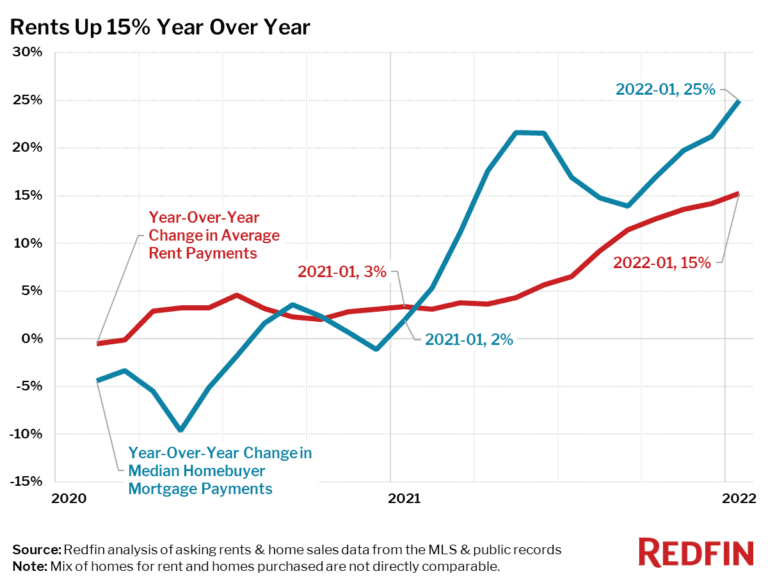

Portland and Austin saw the largest increases, with rents surging more than 30% year over year.

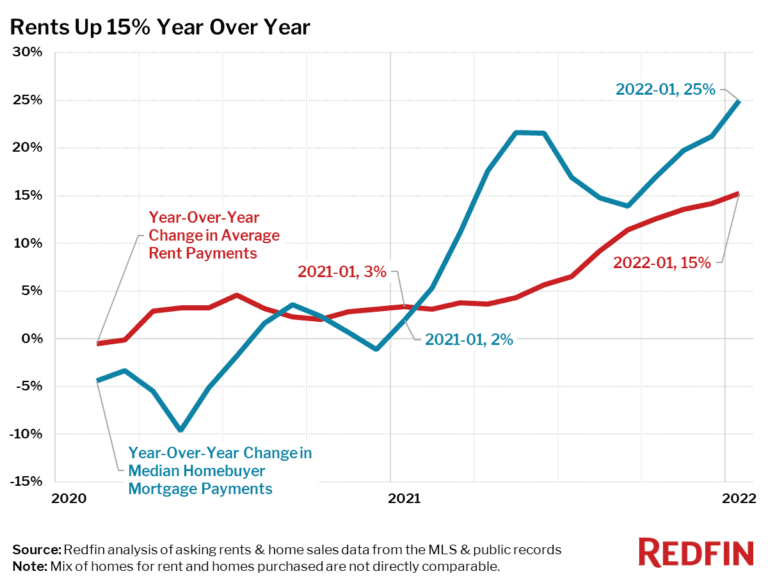

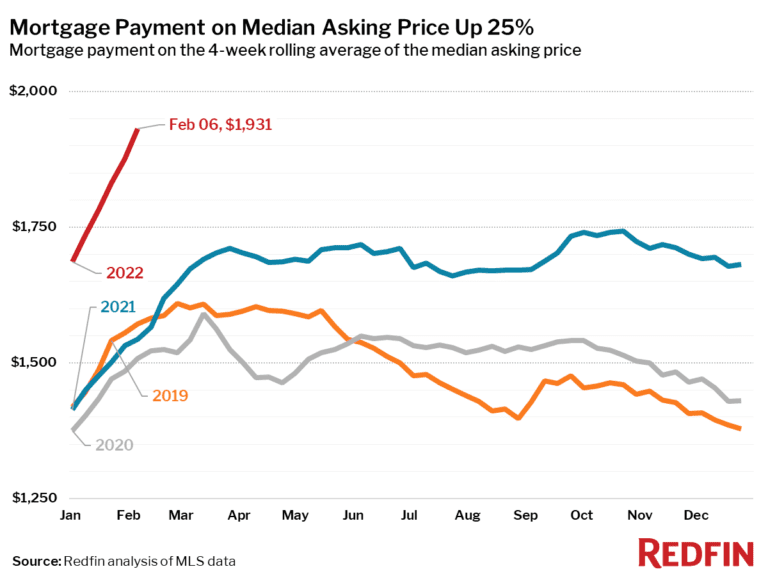

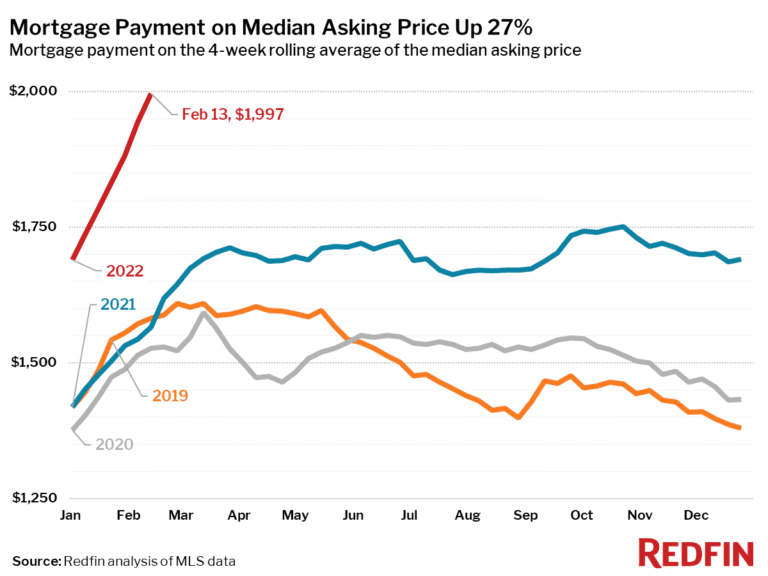

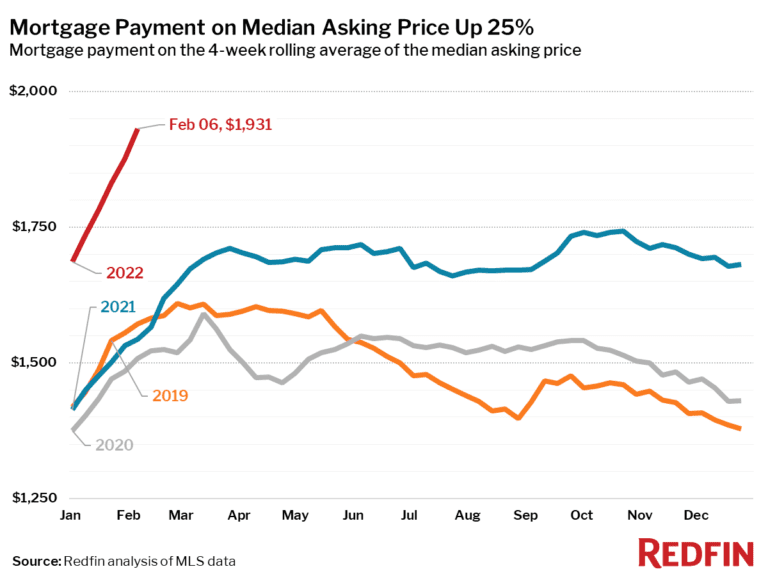

A record 57% of homes sold in two weeks and the typical monthly mortgage payment soared to a new high, approaching $2,000.

People who need to move now are pinched by rising mortgage rates, sky-high home prices and rising rents.

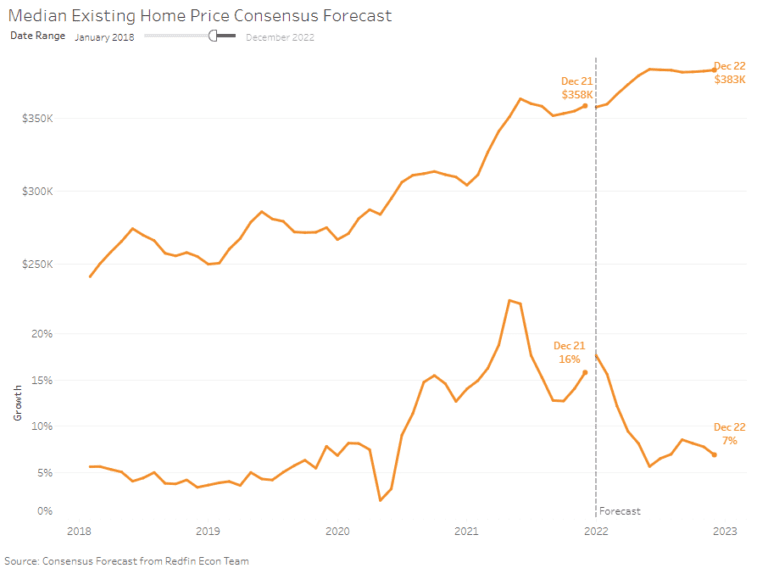

Redfin economists predict mortgage rates will hit 3.9% by the end of the year. At that level, homebuyers could afford a $382,250 home on $2,000

Despite a dearth of homes for sale and the typical monthly mortgage payment reaching a new high, homebuyers are eager to get their foot in the door before mortgage rates tick up further.

Home sales posted strong monthly gains despite rising mortgage rates and record-low supply.

Portland and Austin saw the largest increases, with rents surging more than 30% year over year.

A record 57% of homes sold in two weeks and the typical monthly mortgage payment soared to a new high, approaching $2,000.

People who need to move now are pinched by rising mortgage rates, sky-high home prices and rising rents.

Redfin economists predict mortgage rates will hit 3.9% by the end of the year. At that level, homebuyers could afford a $382,250 home on $2,000

Despite a dearth of homes for sale and the typical monthly mortgage payment reaching a new high, homebuyers are eager to get their foot in the door before mortgage rates tick up further.