- America’s high-fire-risk counties saw a net inflow of 63,000 people last year, driven by migration to Texas.

- High-flood-risk counties saw a net inflow of 16,000, driven by migration to Florida.

- Texas and Florida have attracted a lot of people in recent years because they offer low taxes, relatively affordable housing prices and are building more homes than anywhere else in the nation.

- Recent shifts in migration patterns in California and Florida may indicate that residents are becoming more responsive to climate risk. California’s high-fire-risk areas, for example, saw more people leave than move in last year—a reversal from 2022.

Scores of people are moving to the parts of America endangered by wildfires, flooding and extreme heat, even as those dangers become more frequent and intense.

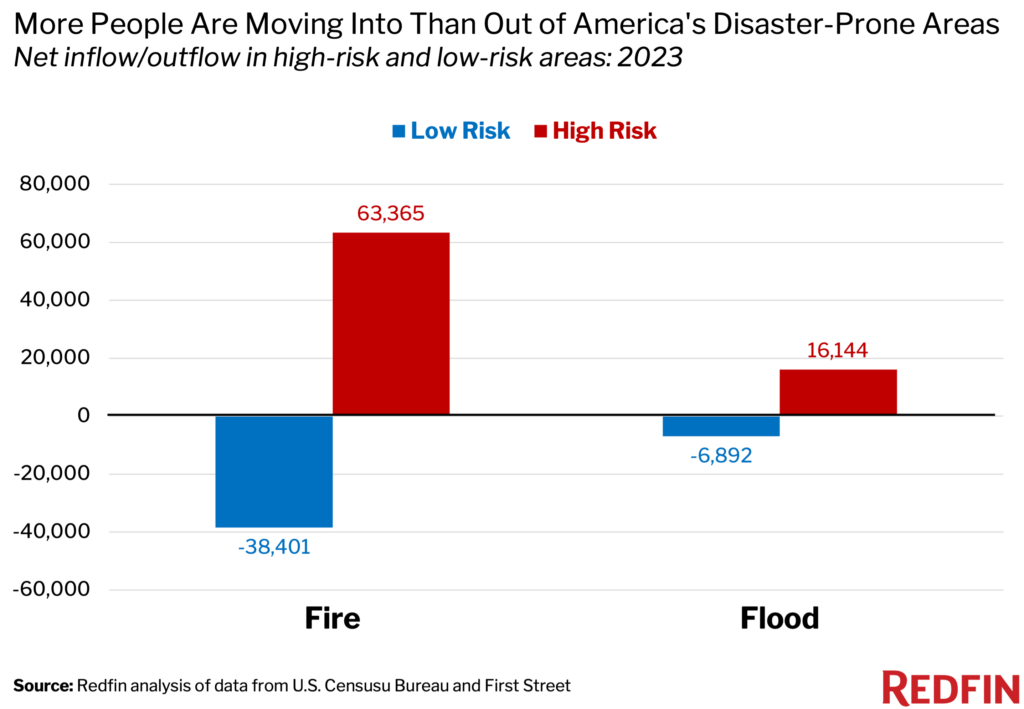

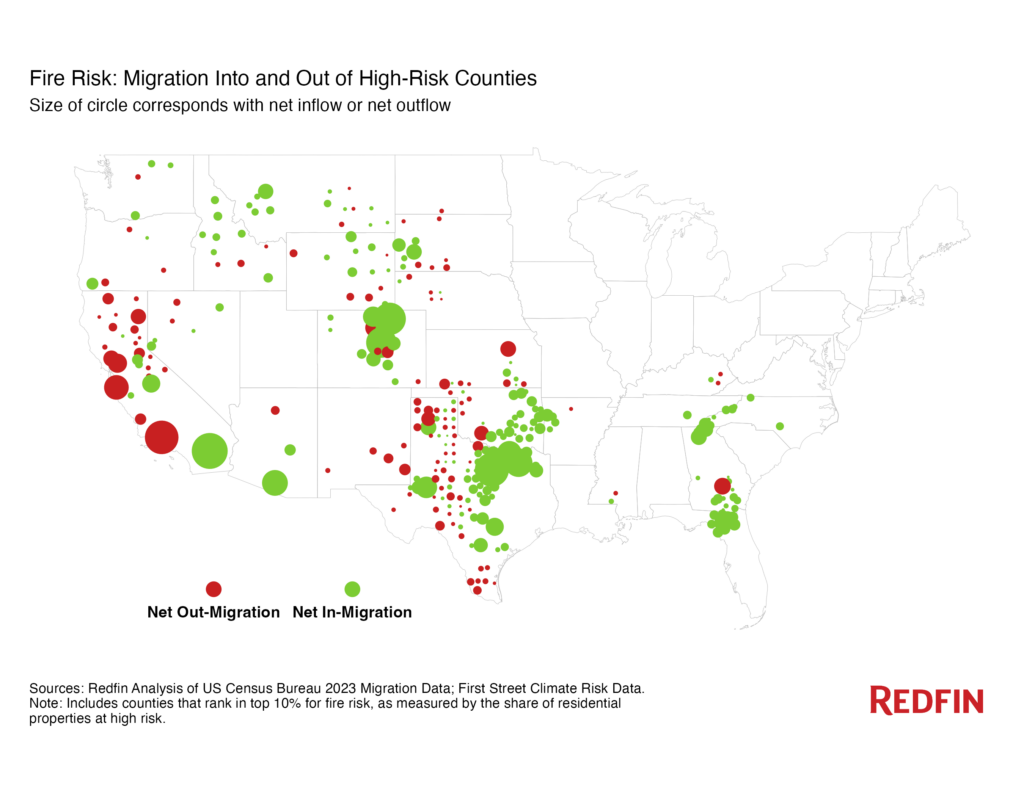

America’s high-fire-risk counties saw 63,365 more people move in than out in 2023. Much of that net inflow was people moving to Texas. But the story differs from state to state; among California’s high-fire-risk areas, more people left than moved in. That marks a reversal from 2022, indicating that people may be growing more responsive to fire risk in the Golden State.

The nation’s high-flood-risk counties saw 16,144 more people move in than out. Florida drove a large share of the migration to high-flood-risk counties, but a smaller share than it did in 2022, indicating that people may be growing more responsive to flood risk in the Sunshine State.

The opposite occurred in low-risk areas; America’s low-fire-risk counties saw a net outflow of 38,401 people in 2023, and low-flood-risk counties experienced a net outflow of 6,892.

This is based on a Redfin analysis of domestic migration data from the U.S. Census Bureau and climate-risk scores from First Street. Census migration data for 2023 covers July 2022-July 2023, and Census migration data for 2022 covers July 2021-July 2022. We define a high-risk county as one that ranks in the top 10% when it comes to the share of homes facing high fire or flood risk. For fire, this means counties with 62.4%-98.9% of homes facing high risk are counted as high-risk counties. For flood, it means counties with 24.2%-99.5% of homes facing high risk are high-risk counties. The remaining counties are referred to as low-risk counties. A net flow is the number of people who moved into an area minus the number of people who moved out. Climate risk scores are based on a property’s current risk as well as how that risk is expected to grow over the next 30 years.

“Ballooning insurance costs and intensifying natural disasters are driving thousands of Americans out of risky areas, but those people are quickly being replaced by other people for whom climate change isn’t the top concern,” said Redfin Senior Economist Elijah de la Campa. “For a lot of Americans, things like cost of living and proximity to family take precedence over catastrophe risk, which can feel less immediate and more abstract. But the cost-benefit calculus seems to be shifting in places like California and Florida, where skyrocketing home insurance costs and an uptick in high-profile disasters have had a tangible impact on residents and made national news.”

Roughly 1 in 11 (8.8%) people who plan to move soon cited concern for natural disasters or climate risks as a reason, according to a Redfin-commissioned survey of roughly 3,000 U.S. homeowners and renters conducted by Qualtrics in February 2024. But other responses were much more common: Wanted more space (32.4%), lower cost of living (26.4%) and to be closer to family (16.4%), to name a few.

While this analysis primarily focuses on fire and flood risk, we also took a look at extreme heat. The trend is similar; high-heat-risk counties saw a net inflow of 271,413 people last year. We define a high-heat-risk county as one where 100% of homes face high risk. Inflow numbers are much higher for heat because there are so many counties where 100% of homes face high risk (910, to be exact; compared with zero for fire and flood risk).

A Lot of People Are Moving to Texas, Which Faces High Fire Risk

Migration to fire-prone Texas fueled a significant portion of the national net inflow to high-fire-risk areas last year. Let’s do the math:

- A total of 97,535 people moved into high-fire-risk U.S. counties, while 34,170 moved out, which is how we got a net inflow of 63,365 in section one.

- 35,175 of the aforementioned 97,535—or 36.1%—were people who moved to Texas. That’s up from 28.7% in 2022. All in all, high-fire-risk counties in Texas saw a net inflow of 30,156—a big chunk of the nationwide net inflow.

Texas is home to five of the 10 high-fire-risk counties that saw the largest net inflows of people last year. Four of those counties are located in the area surrounding Dallas-Fort Worth, which is home to a lot of state park land.

| County | State county is in | Net inflow (2023) | Share of homes facing high fire risk |

| Riverside County | California | 7,807 | 78.5% |

| Parker County | Texas | 6,960 | 78.0% |

| Weld County | Colorado | 6,254 | 63.8% |

| Douglas County | Colorado | 5,465 | 93.7% |

| Hunt County | Texas | 4,530 | 71.4% |

| Pima County | Arizona | 3,823 | 72.5% |

| Grayson County | Texas | 3,441 | 66.5% |

| Wise County | Texas | 3,008 | 68.3% |

| Midland County | Texas | 2,584 | 77.1% |

| Larimer County | Colorado | 2,249 | 66.2% |

Texas isn’t often the first state that comes to mind when people consider fire risk, but it had more wildfires last year (7,102) than any state but California (7,364), and actually did have the highest number of wildfires in 2022. Aside from California, the Lone Star State also has the greatest number of homes in the Wildland Urban Interface—the part of the country where developed land intermingles with undeveloped land, making it especially vulnerable to wildfires.

In general, Texas has attracted a lot of people in recent years because it has low taxes, relatively affordable housing prices and is building more homes than anywhere else in the country. And while it has made headlines for extreme weather events, it hasn’t made national news quite like California and Florida, which may be one reason people are still moving to the Lone Star State in droves. California and Florida are known to be the epicenters of the housing insurance crisis, but house hunters should know that Texas also has some of the most expensive insurance in the country, in part because it’s vulnerable to hurricanes and flooding.

Flood-Prone Houston Bucks the Trend, With More People Leaving Than Moving In

Five high-flood-risk counties in Texas had net inflows of more than 2,000 people in 2023. All are just outside of Houston, which last month grappled with flooding and power outages due to Hurricane Beryl, along with sweltering heat.

Harris County, which includes Houston proper and also faces high flood risk, is an outlier. It saw a net outflow of 22,792 people last year. That may partly reflect families moving to the suburbs, which gained popularity during the pandemic as remote work allowed people to prioritize things like big homes and access to nature over proximity to the office. But there are also climate migrants—people leaving due to climate risk. Redfin Premier real estate agent Nicole Nodarse is one; she’s leaving Houston in August for Salem, OR.

“The main climate issue in Houston is flooding, but the major factor driving me away is the heat. I don’t want to go through another Houston summer,” Nodarse said. “But a lot of people are still moving here because they like the low prices and the politics. Homeowners insurance is becoming a big deal, though; it’s much more expensive than it used to be, and a lot of people who installed 30-year roofs are now having to replace them after 15 years because some insurers won’t cover the home if the roof is older than that.”

Nearly one-third (31.4%) of homes in Harris County face high flood risk, and 100% of homes face high heat risk.

A Lot of People Are Moving to Florida, Which Faces Extreme Flood Risk

Migration to flood-prone Florida fueled a sizable chunk of the national net inflow to high-flood-risk areas last year. Here’s the breakdown:

- A total of 219,799 people moved into high-flood-risk U.S. counties, while 203,655 moved out, which is how we got a net inflow of 16,144 in section one.

- 117,574 of the aforementioned 219,799—or 53.5%—were people who moved to Florida. All in all, high-flood-risk counties in Florida saw a net inflow of 68,564—contributing significantly to the national net inflow. (The national net inflow is smaller than the Florida net inflow because the Florida net inflow was partly offset by outflows in other areas.)

- While Florida’s impact on the national figure is large, it has shrunk; Florida accounted for 53.5% of migration to high-flood-risk areas in 2023, down from 57.3% in 2022. This could be because people are becoming more aware of flood risk and surging insurance costs.

Florida is home to six of the 10 high-flood-risk counties that saw the largest net inflows of people last year. All six are located on the Florida coast.

| County | State county is in | Net inflow (2023) | Share of homes facing high flood risk |

| Fort Bend County | Texas | 15,757 | 39.2% |

| Brevard County | Florida | 14,886 | 24.2% |

| St. Johns County | Florida | 12,309 | 29.4% |

| Volusia County | Florida | 12,284 | 30.7% |

| Manatee County | Florida | 11,300 | 29.2% |

| Sarasota County | Florida | 8,526 | 29.3% |

| Lee County | Florida | 8,374 | 50.4% |

| Brazoria County | Texas | 7,888 | 53.8% |

| Brunswick County | North Carolina | 7,796 | 26.6% |

| Sussex County | Delaware | 7,329 | 28.8% |

Miami bucks the trend. Miami-Dade County, where 38.9% of homes face high flood risk, saw a net outflow of 47,597 people in 2023. That’s a bigger outflow than almost any other county in the nation. Some people have left due to climate dangers, but many have been priced out due to the surge in housing costs during the pandemic. The median home sale price in the Miami metro area is $555,000, up almost 75% from $319,000 at this time in 2019.

“Miami has gentrified. Many of the people who are selling their homes now are moving elsewhere because they can no longer afford to live here given the rise in interest rates, housing prices, insurance costs and HOA fees for condo dwellers,” said Rafael Corrales, a Redfin Premier agent in Miami. “A lot of the buyers in the market are paying in cash, which allows them to forgo homeowners insurance. That means they don’t have to deal with skyrocketing premiums, but it also means they’re on their own if a storm hits.”

Florida exploded in popularity in recent years for the same reasons Texas did: Low taxes, reasonable home prices (at least compared to many other coastal areas), and a lot of new homes. Many people also moved to the Sunshine State for, well, the sunshine—and the politics. But now, many housing markets in Texas and Florida are slowing amid rising inventory and intensifying climate risk.

Florida, along with California, is in the middle of a housing-insurance crisis. Many homeowners have seen their premiums skyrocket, and some have lost coverage altogether because intensifying natural disaster risk has prompted many insurers to stop doing business in the two states. The good news is that homes being built in Florida today tend to be more resilient than older homes because they must adhere to stricter, modern building codes.

“Prospective homebuyers are asking me a lot more questions about natural disasters and insurance costs than they were previously. About three-quarters of the sellers I speak to express frustration over recent increases in their insurance premiums,” Corrales said. “If you’re looking to buy a home in Florida, you should know that you can’t be close to the water without being in a flood zone. If you’re within three miles of the coastline, mother nature is going to pay you a visit. That’s the price you pay for living in paradise.”

People Are Leaving Fire-Prone California

While fire-prone America saw more people move in than leave in 2023, there were still a lot of people who left, and many of them left California:

- A total of 34,170 people left high-fire-risk U.S. counties last year.

- 17,357 of those people—or 50.8%—left California. That’s up from 41.9% in 2022, which may signal that people in the Golden State have grown more responsive to fire risk.

- Overall, California’s high-fire-risk areas saw a net outflow of 6,937 people in 2023. That marks a reversal from 2022, when high-fire-risk counties saw a slight net inflow (+763).

California is home to five of the 10 high-fire-risk counties that saw the largest net outflows of in 2023. Two of those counties are in and around Napa, which has sustained significant wildfire damage in recent years, and another is north of Lake Tahoe, which has also been hit by wildfires. The remaining two are on the coast—one is next to Santa Barbara and one includes the city of Santa Cruz. Many of these counties also have high home prices, which may be pushing some people out of the area.

| County | State county is in | Net outflow (2023) | Share of homes facing high fire risk |

| Ventura County | California | (6,754) | 67.7% |

| Santa Cruz County | California | (3,455) | 68.6% |

| Solano County | California | (1,965) | 66.8% |

| Boulder County | Colorado | (1,919) | 68.1% |

| Telfair County | Georgia | (1,455) | 70.2% |

| Napa County | California | (1,339) | 71.8% |

| Geary County | Kansas | (1,252) | 63.2% |

| Lassen County | California | (1,179) | 81.0% |

| Comanche County | Oklahoma | (1,057) | 70.3% |

| Potter County | Texas | (994) | 76.4% |

“We live between the ocean and the bay, with the beautiful coastal mountains between, which means we have high fire risk, flood risk, and always the potential for an earthquake,” said Julie Zubiate, a Redfin Premier agent in the Bay Area. “I recently had a condo almost fall out of contract because Fannie Mae switched my client from approved to unapproved while under escrow. Fannie Mae decided the home’s HOA wasn’t protected enough from climate disasters. It took awhile, but we found a lender willing to take on the risk—but at a higher cost to my clients.”

Allstate, California’s sixth largest insurer, is seeking to raise homeowners insurance costs by 34% on average. That would impact over 350,000 people and exceed the 30% hike sought last month by State Farm, the biggest insurer in the state. Allstate stopped writing new homeowners policies in California in 2022.

“We’re getting a lot of transplants from California and Florida who are concerned about climate change,” said Kristin Sanchez, a Redfin Premier agent in Nashville. “Many of them are moving here to escape insurance costs that have become unaffordable.”

Methodology

Climate risk data for fire, flood and heat comes from the First Street, which assigns six different climate-risk categories to properties across the U.S.—minimal, minor, moderate, major, severe and extreme. For this report, a “high-risk” property is one that falls into the major, severe or extreme category for a climate risk. The climate risk scores are based on a property’s current risk as well as how that risk is expected to grow over the next 30 years.

We identified counties in the contiguous U.S. that rank in the top 10% for flood and fire risk and roughly the top 33% for heat risk, as measured by the share of residential properties at high risk; for heat risk, high-risk counties are those where 100% of properties face high risk. For every county identified, we calculated the net domestic migration for 2023 using the U.S. Census Bureau’s Vintage Population Estimates data. Net domestic migration is the difference between the number of people moving into an area and the number moving out. A positive number indicates in-migration and a negative number indicates out-migration.